The bottled water distribution industry is highly competitive, where profitability and customer trust depend as much on accurate financial management as on reliable deliveries. Handling payments, generating invoices, tracking deposits, and reconciling accounts manually are time-consuming and prone to errors.

This is where the finance and accounting of water jar management software comes in. Water Delivery Solutions (WDS) offers delivery software that is specifically designed to cater to water distribution businesses. It provides finance and accounting features, such as automated invoicing, payment reminders, digital deposit tracking, and bank reconciliation, ensuring you stay financially organized while improving customer satisfaction.

Table of contents

What is finance and accounting in water jar management software?

In water jar management software, the finance and accounting module is a suite of tools designed to handle all financial transactions, revenue generated, and expenses while ensuring records comply with accounting standards. Water distribution businesses employ various sales models, including subscriptions, bulk orders, on-time sales, and direct sales. Therefore, the finance and accounting features ensure accuracy, transparency, and efficiency in managing and reporting money.

The finance and accounting module of the water delivery management software includes;

- Order-to-cash management – The system automatically records revenue from subscriptions, on-time deliveries, and bulk orders. You can track pending, completed, and canceled payments. Customer invoices are linked to their respective orders for better traceability.

- Automated invoicing and billing – The system generates invoices, both digital and printed via thermal printers, for every transaction. It supports recurring billing for subscription customers. The system automatically applies discounts, taxes, and promotional pricing.

- Payment management – The system enables you to accept multiple payment modes, including cash, cards, UPI, digital wallets, or bank transfers. It matches collected payments against open invoices to avoid mismatches. It also tracks outstanding dues and sends automated reminders.

- Jar/container deposit & return accounting – The system maintains accounts for refundable security deposits taken for jars or bottles. It automatically adjusts accounts when jars are returned or not recovered.

- Integration with accounting systems – The system synchronizes seamlessly with ERP or third-party accounting tools, such as QuickBooks or Xero. This avoids data entry duplication and ensures accurate bookkeeping.

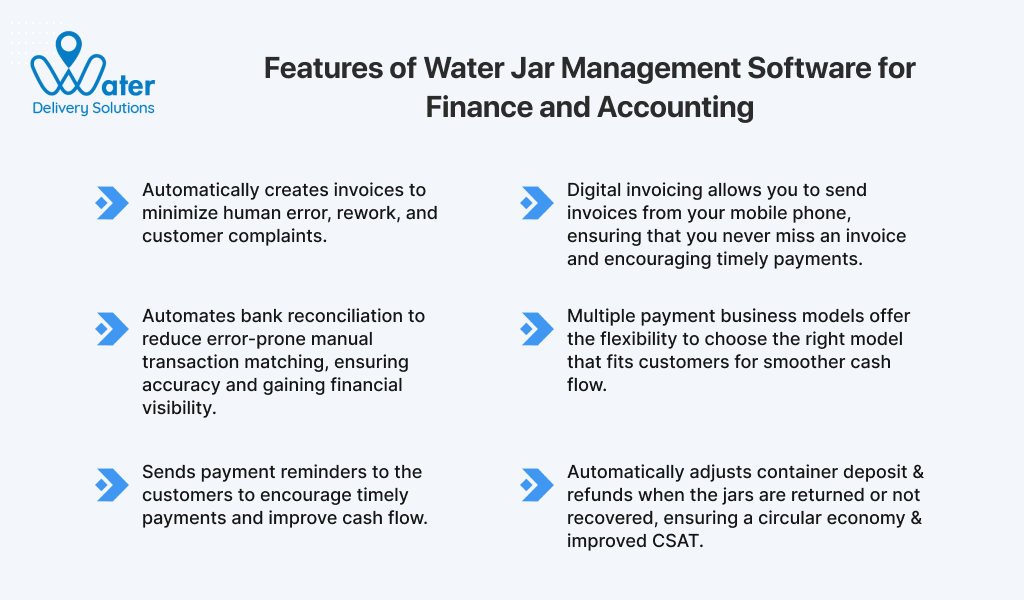

Finance and accounting features of water jar management software

The finance and accounting module in water jar management software helps streamline financial operations, reduce errors, and ensure smoother payment handling. It integrates sales, deliveries, and customer accounts into a single system, giving both customers and businesses transparency and control. Finance and accounting features of water jar management software:

Multiple payment gateway integrations

The bottled water delivery software supports multiple payment gateway integrations, including UPI, cards, wallets, and net banking, allowing customers to pay using their preferred methods. This flexibility enhances overall customer experience and ensures faster, on-time payment, reducing collection delays. Diversifying payment options can help reduce their dependency on cash transactions, lowering the risks of theft or mismanagement.

Automatically creates invoices

The system automates invoice generation, whether it is a subscription, a one-time order, or a bulk purchase. This reduces manual efforts, minimizes human errors, and helps avoid rework or customer complaints caused by incorrect billing. The system generates invoices based on the successful deliveries made. It applies correct pricing, discounts, and taxes without human intervention. This ensures error-free billing, reduces rework, and prevents disputes or complaints from customers, leading to smoother transactions.

Digital invoicing

With digital invoicing, businesses can send invoices directly from a mobile phone. This ensures no invoice is ever missed, and customers receive their bills instantly. Quick access to invoices encourages timely payments and boosts trust with customers. For businesses, digital invoicing means fewer missed invoices, reduced payment collection delays, and improved tracking of pending bills.

Automates bank reconciliation

The system automatically matches incoming transactions with bank statements, eliminating the need for error-prone manual checks. This ensures financial accuracy, provides better cash flow visibility, and reduces time spent on reconciliations. Any mismatches are flagged instantly. This reduces financial discrepancies, saves hours of manual work, and provides clear financial visibility for decision-making.

Multiple payment business models

The software supports cash-on-delivery, prepaid, postpaid invoicing, subscriptions, and hybrid models. The payment models the water delivery management software supports are:

- Prepaid models – Customers pay in advance while placing the order.

- Postpaid – Customers pay after delivery is done. For postpaid, the invoices are generally raised monthly or weekly.

- Subscription-based billing – This includes recurring billing for subscription order deliveries on a regular period.

- Cash on delivery – Customers make payment while the order is being delivered.

- Hybrid models – Mix of payment models. You can implement a different payment model for various customer segments.

This flexibility enables businesses to select the right model for each customer segment, ensuring smooth cash flow and building stronger relationships with both B2B and B2C clients.

Sends payment reminders

Automates payment reminders to notify customers of upcoming or overdue payments. The system automatically sends notifications through SMS, email, or app alerts. It notifies customers before due dates, on due dates, and after overdue periods. These timely alerts encourage faster settlements, reduce outstanding dues, and improve the business’s overall cash flow without pressure on delivery staff to chase payments.

Auto-adjusts container deposit & returns

Since water jars and bottles are reusable, businesses often charge a refundable security deposit. Tracking these manually can cause confusion and disputes. For jars and bottles with refundable deposits, the system automatically adjusts accounts when containers are returned or marked as unrecovered. This promotes a circular economy model, reduces losses, and improves customer satisfaction by maintaining clear deposit records.

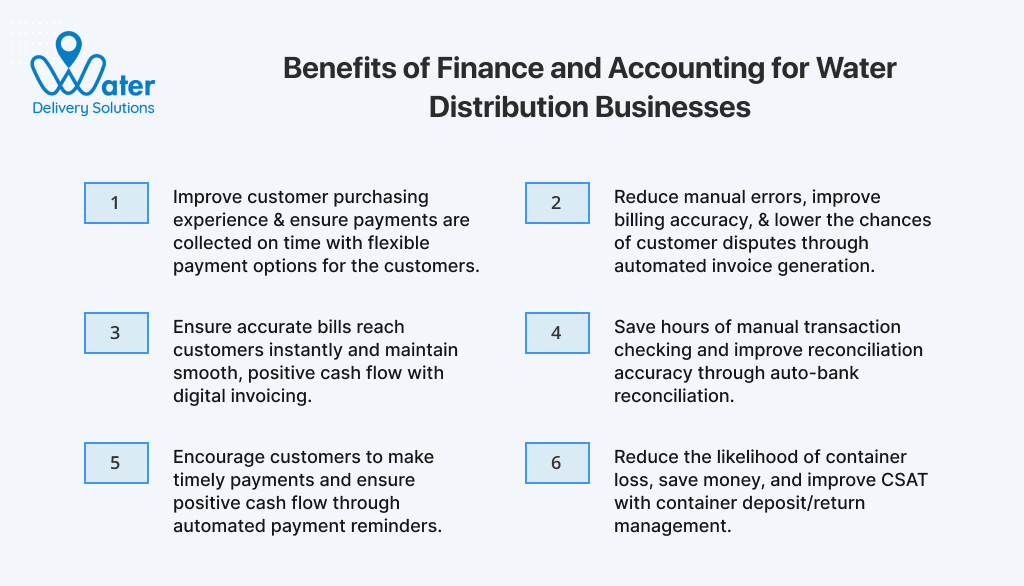

Benefits of finance and accounting for water distribution businesses

Efficient finance and accounting functions are the backbone of every water distribution business. Automating key processes, such as billing, reconciliation, and deposit tracking, saves time, improves customer experience, and strengthens cash flow. Below are the benefits of finance and accounting for bottled water distribution businesses:

Improve customer experience

Customers can pay using their preferred payment methods, including cash, UPI, cards, wallets, or bank transfers. This water delivery system integrates with multiple payment gateways, allowing you to offer both online and offline options. This enhances their purchasing experience, increases satisfaction scores (SCAT), and ensures timely payments.

Reduce manual errors, improve accuracy

The system automatically creates invoices based on deliveries and consistently applies taxes, discounts, and pricing, minimizing errors. This enables businesses to save time, avoid billing-related complaints, and improve credibility with customers. Automation reduces manual errors, rework, and operational costs while improving billing accuracy and lowering customer disputes.

Ensure accurate billing

The system replaces paper bills by generating digital invoices and sending them via mobile phone, email, or app notifications. Customers receive timely bills, which reduces payment delays and helps businesses maintain steady working capital. Digital invoicing accelerates payment collections, ensures accurate bills reach customers instantly, and maintains smooth cash flow.

Improves financial transparency

The bottled water delivery software matches bank transactions with recorded invoices and payments. The system flags any discrepancies immediately, reducing errors and ensuring the books always reflect accurate financial health. This improves financial transparency and accelerates audits. This saves hours of manual transaction checking, improves accuracy, and gives business owners financial visibility.

Fosters timely payments

The system sends automated notifications to customers via SMS, email, or mobile app before due dates, on due dates, and after overdue periods. This eliminates the need for delivery staff to follow up manually and significantly reduces outstanding receivables. Automated payment reminders encourage customers to make prompt payments, ensuring timely revenue collections and fostering healthier cash flow.

Reduce container losses

The system maintains a clear digital record of collected security deposits and automatically adjusts balances when customers return or fail to return containers. This transparency reduces disputes, saves money on lost assets, and enhances customer satisfaction. Container deposit and return management prevents losses due to unreturned jars, improves customer trust, and promotes a circular economy model.

Conclusion

Efficient finance and accounting operations are the backbone of every successful water distribution business. Implementing water delivery software offers advanced features, including flexible payment options, automated billing, digital invoicing, smart reconciliation, and transparent deposit management. This enables you to collect payments faster and deliver a better customer experience. Schedule a meeting to discuss your bottled water business workflow.

He loves to explore. His passion for helping delivery industries in all aspects flows through in the vision he has. In addition to providing smart solution to make delivery process flawless, Ravi also likes to write sometimes to make it easier for people from business industry looking for digital solutions.